IRS 8821 2021-2025 free printable template

Instructions and Help about IRS 8821

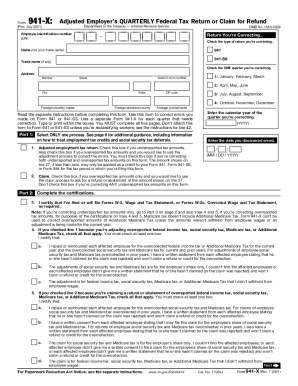

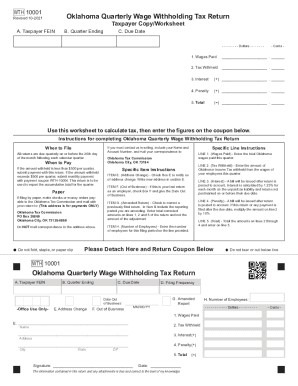

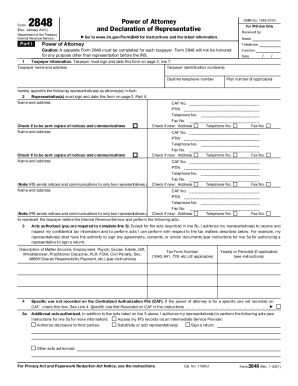

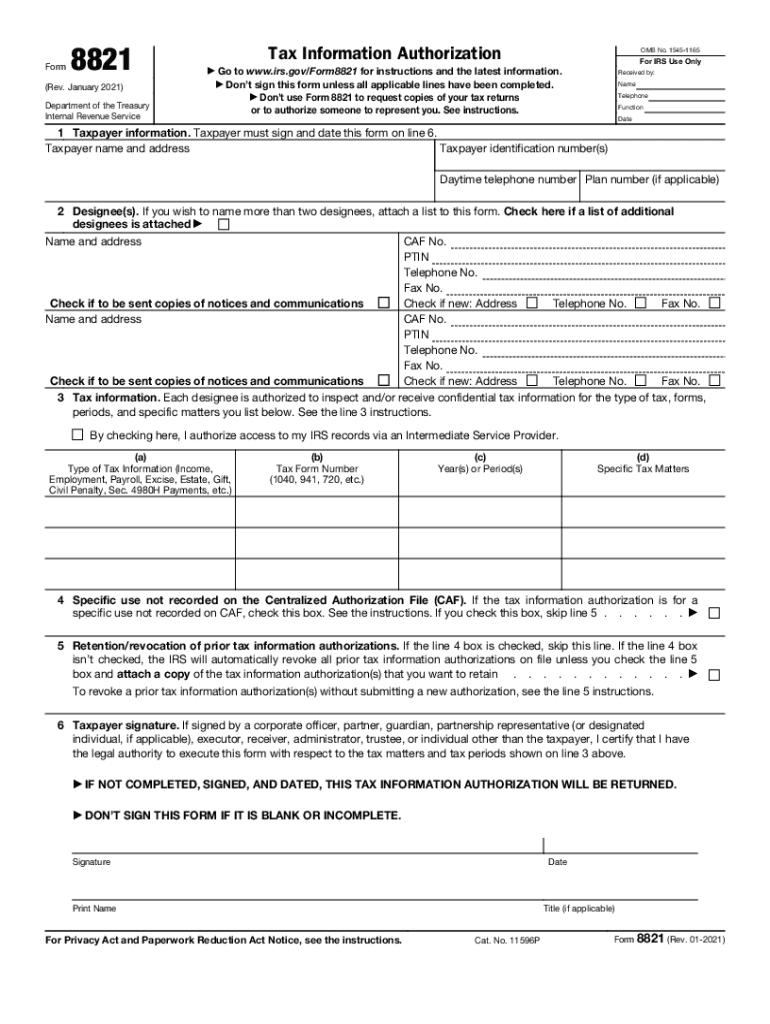

How to edit IRS 8821

How to fill out IRS 8821

Latest updates to IRS 8821

All You Need to Know About IRS 8821

What is IRS 8821?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8821

How can I correct mistakes made on my IRS 8821 form?

If you need to correct errors on your IRS 8821, you must submit a new form with the correct information. Clearly indicate that it is a corrected submission and retain a copy for your records. Ensure that you also follow up to verify that the updated form has been processed successfully.

What steps should I take to track the status of my IRS 8821 submission?

To track the status of your IRS 8821 submission, you can contact the IRS directly or use their online tools if available. It's important to keep your confirmation or any correspondence handy to assist in tracking. Common issues involve processing delays or rejection codes that you can inquire about.

Are there specific legal concerns regarding privacy when submitting IRS 8821?

When submitting IRS 8821, it's crucial to consider privacy and data security implications. Ensure that the information provided is kept confidential and shared only with authorized parties. Retain proper documentation per IRS guidelines to protect sensitive data.

What common errors should I watch out for when filing my IRS 8821?

Common errors when filing IRS 8821 include incorrect taxpayer identification numbers and issue with agent signatures. Double-check all entries before submission to avoid delays or potential rejections, ensuring all necessary information aligns with IRS requirements.

What should I do if I receive an audit notice after submitting my IRS 8821?

If you receive an audit notice after submitting your IRS 8821, promptly review the notice and gather all relevant documentation related to the filing. Respond in a timely manner, as indicated in the notice, providing any requested information to facilitate the audit process.

See what our users say